Friday, October 30, 2020

Delisted shares unregistered: USDY and IDY

New ETF Listing Alert: Global X Emerging Markets Internet & E-commerce ETF (EWEB)

Global X Emerging Markets Internet & E-commerce ETF

Ticker: EWEB

Expense ratio: 0.65%

Exchange: NASDAQ

Index: NASDAQ Emerging Markets Internet & E-commerce Index

Listing: November 11, 2020

CUSIP: 37954Y244

Global X's 78th ETF: Global X currently has USD$15 billion across 77 products, for gross annual revenue of USD$88 million.

Thursday, October 29, 2020

New ETF Filing Alert: iShares Cloud and 5G Multisector ETF

Re-using an old non-effective filing: iShares Cloud and Digital Infrastructure Exposure ETF from 2018

Ticker: N/A

Expense Ratio: N/A

Effective Date: January 11, 2021 (Monday)

Index: Morningstar® Global Digital Infrastructure & Connectivity Index

The Underlying Index provides exposure to the top 50 companies identified by Morningstar’s Equity Research team as a producer of promising digital infrastructure technologies consisting of two themes:

- Cloud computing, which enables cloud computing applications through Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) solutions; and

- 5G, which enables next generation connectivity through fifth generation broadband cellular networks.

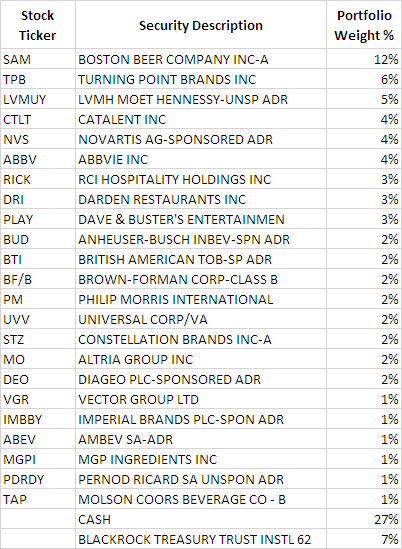

Listing Transfer Alert: Vice ETF to change from NASDAQ to NYSE arca

Wednesday, October 28, 2020

New ETF Listing Alert: iShares US Small Cap Value Factor ETF

Ticker: SVAL

Expense Ratio: 0.30%

Index: Russell 2000 Focused Value Select Index

Exchange: Cboe BZX Exchange, Inc.

The Underlying Index measures the performance of small-capitalization

U.S. companies with prominent value factor characteristics, as determined by

the Index Provider. The Underlying Index is a subset of the Russell 2000® Index (the “Parent Index”), which measures

the performance of the small-capitalization segment of the U.S. equity market,

as defined by the Index Provider.

The construction of the Underlying Index begins with the Parent Index and excludes companies that are ranked in the least liquid 20% (i.e. approximately 400 constituents) based on the 60-day average dollar value traded. The list of eligible constituents is then narrowed to exclude the top 20% of Parent Index constituents with the highest risk based on a 12-month trailing realized volatility. The list is further narrowed to exclude the top 20% of Parent Index constituents with the highest leverage, which is measured by comparing a company’s total debt to its total assets. Following these three initial screens, the remaining companies are evaluated to exclude companies with a negative sentiment score, which is calculated using the number of upgrades for earnings per share and the number of downgrades for earnings per share for a company's current and next fiscal year. A company with more downgrades for earnings per share than upgrades will have a negative sentiment score, and thus will be excluded from the Underlying Index. The remaining companies are then ranked based on a weighted composite score of three value factor metrics; price-to-book, price-to-earnings and price-to-cash flow from operations (the “Composite Score”). The top 250 ranked stocks are selected and equally weighted to form a baseline or target composition (the “Target Index”). The Underlying Index will be reviewed monthly and rebalanced to the Target Index if either of the following conditions are met: (i) the Underlying Index’s Composite Score is less than 90% of the Target Index's Composite Score; or (ii) the Underlying Index has fewer than 200 securities. If no rebalance is triggered, the component securities of the Underlying Index and their weights will remain unchanged. The Underlying Index may contain fewer than 250 stocks and may not rebalance for a period of time.

As of August 31, 2020, a significant portion of the Underlying Index is represented by securities of companies in the financials and industrials industries or sectors. The components of the Underlying Index are likely to change over time. As of August 31, 2020, the Underlying Index was comprised of 248 components.

New ETF Filing Alert: FT Cboe Vest Fund of Deep Buffer ETFs (Actively-managed)

Actively-managed ETF that provides exposure to S&P 500 via SPY ETF, and downside protection by investing in four other First Trust ETFs that invest in S&P 500 options.

Filed: October 28, 2020 | 14:21:54 ET

Effective Date: Tuesday, January 26, 2021

Ticker: N/A

Expense Ratio: N/A

New ETFs filed (Actively Managed) - "Sound" ETFs

Five Actively-Managed ETFs filed

Effective date: January 13, 2021 (Wednesday)

Tickers: N/A

Expense Ratio: N/A

- Sound Fixed Income ETF Summary

- Sound Enhanced Fixed Income ETF Summary

- Sound Equity Income ETF Summary

- Sound Enhanced Equity Income ETF Summary

- Sound Total Return ETF Summary

Advisor: Toroso Investments, LLC

Trust: Tidal ETF

Sub-advisor: Sound Income Strategies, LLC

DVP to DEEP: Roundhill Deep Value ETF finalizes changes to new ticker, index, brand

ETF Name: Roundhill Acquirers Deep Value ETF

Ticker: DEEP

Expense Ratio: 0.80%

New ETF Filing Alert: MIRAE/Global X Adaptive U.S. Risk Management ETF

ETF Name: Global X Adaptive U.S. Risk Management ETF

Ticker: ONOF

Expense Ratio: 0.39%

Filed: October 21, 2020

Effective date: January 4, 2021 (Monday)

Index/investment strategy: Adaptive U.S. Risk Management Index developed by Carroll Financial and calculated by Solactive

Adviser: Global X Management Company LLC

Summary

ETF invests in 500 large cap equities (probably the same as the S&P500 but not explicitly stated to avoid trademark issues) or in US 1-3 Treasuries. Four signals will determine whether the ETF invests in equities or Treasuries.

Objective of this strategy is to have exposure to the performance of a broad basket of US equities while partially shielding performance from downturns, based on popular trend-based metrics.

Product Analysis

- Investment Merit

- This strategy takes four difference trend indicators for a rules-based investment strategy. Why not?

- Commerciability

- Easy to explain to investors so may be popular with investment advisors who want to show their US clients that they're not just investing in the S&P 500.

- Sale has to be done in the first sentences of the pitch otherwise the investor will be overwhelmed.

- Feasibility

- Operationally straightforward as it's replicating an index of US large-cap securities. However, the 100% turnover swing from all equities to US Treasuries and vice-versa in three days may incur substantial operating costs. The four signals should make these moves infrequent, but the lag will also dampen the full effect of the up and downsides.

Investment Process

Mitigate downside volatility of US equity position by investing in constituents of a US index of 500 securities or in US Treasuries with 1-3 years to maturity depending on four signals.

- SMA (200-day simple moving average)

- MACD (moving average convergence divergence)

- Drawdown Percentage (drop from recent peak price of the US equity position)

- VIX (Cboe Volatility Index)

- If ETF in equity position, requires three signals to change to US Treasuries

- If ETF in US Treasuries, requires only two signals.

Three trading days to move positions.

Further information:

Index (Solactive) methodology here.

Index developer Carroll Financial, a financial advisory firm.

Triggers rules in prospectus here. Extract below:

Portfolio Managers:

John Belanger, CFA; Nam To, CFA; Wayne Xie; Kimberly Chan; and Vanessa Yang

Saturday, October 24, 2020

New ETF Filing Alert (actively-managed): Euclid Capital Growth ETF

Name: Euclid Capital Growth ETF

Ticker: Not available yet

Expense Ratio: Not available yet

Effective date: December 30, 2020 (Wednesday)

Index/investment strategy: Actively-managed. Invests mainly in other ETFs.

Trust: Tidal ETF

Adviser: Toroso Investments, LLC

Sub-Adviser: Euclid Investment Advisory, LLC - "market-driven, time-proven, compound capital gains, reduce investment risk"

Euclid's Investment Management Process

Seems more rules-based technical analysis + some fundamental analysis than active. Maybe active refers mainly to the act of buying and selling positions? From their website:

- Ranking Determined by Proprietary Relative Strength Technical Analysis

- Sector-Specific Fundamental Factors Considered

- Ranking Determined by Proprietary Relative Strength Technical Analysis

- Sector-Specific Fundamental Factors Considered

- Steps 1 & 2 Clearly Identify Top Ranked ETF Positions to Own

- Weighting to Model Positions Determined By Relative Strength and Market Dynamics

- Steps 1 & 2 Repeated on a Weekly Basis

- Buy and Sell Action Determined By Rising or Falling Technical and Fundamental Indicators

Friday, October 23, 2020

New ETF Filing Alert (Actively-managed) : Virtus Newfleet ABS/MBS ETF

Ticker (tentative): VABS

Expense Ratio: Not available yet

Effective date: December 30, 2020 (Wednesday)

Index: Actively-managed. Seeks income.

Trust: Virtus ETF 2

Adviser: Virtus Investment Partners

Sub-Adviser: Newfleet Asset Management "Identifying relative value is the foundation of our process; active sector rotation."

AFTY - CSOP FTSE A50 China ETF - finalizes transition from CSOP to Pacer Funds

AFTY - CSOP FTSE China A50 ETF finalizes transition to Pacer Funds.

CSOP ceases to be an investment manager in the USA. Official order here.

New prospectus here, filed in December 2019 .

Thursday, October 15, 2020

Shariah Global REIT ETF - new filing alert

Ticker (tentative): SPRE

Expense Ratio: Not available yet

Effective date: January 11, 2021 (Monday)

Index: S&P Global Sharia [sic] All REIT Capped Index

Trust: Tidal ETF Trust

Sub-Adviser: Naushad Virji of ShariaPortfolio, Inc. "Comprehensive Halal Wealth Management"

Sub-adviser already launched two other ETFs:

- SPUS The SP Funds S&P 500 Sharia Industry Exclusions ETF

- AUM: $33M

- Inception: 12/18/2019

- Expense Ratio 0.49%

- 30 day SEC yield 0.83%)

- SPSK The SP Funds Dow Jones Global Sukuk ETF

- AUM: $30M

- Inception: 12/30/2019

- Expense Ratio 0.65%

- 30 day SEC yield 1.14%)

INDEX INFORMATION

S&P Global Sharia [sic] All REIT Capped Index: includes all real estate investment trust (“REIT”) securities listed in developed and emerging markets and included as constituents of the S&P Global BMI Shariah Index.

S&P Global BMI Shariah Index - (Methodology)

Universe index overview (3 main steps)

Screens provided by Ratings Intelligence Partners, an independent London/Kuwait-based consulting company.

1. First Screening

Companies that receive more than 5% revenue from Sharia-prohibited business activities are removed. These activities include:

- Advertising of all non-Islamic activities

- Media & Entertainment (certain producers, distributors and broadcasters of music, movies, television shows and musical radio shows and cinema operators)

- Alcohol production or sale

- Cloning

- Conventional Finance (except: Islamic Banks, Islamic Financial Institutions and Islamic Insurance Companies)

- Casino management and gambling

- Pork-related products or production, packaging, and process or any other activity related to pork

- Pornography

- Tobacco manufacturing or sale

- Trading of gold and silver as cash on deferred basis

2. Second screening

Remaining companies’ finances are further examined to ensure they are Sharia compliant. Only those companies that satisfy the following financial ratios will be considered Sharia compliant:

- Debt is less than 33.333% of total assets;

- Cash and interest-bearing items are less than 33.333% of total assets;

- Accounts receivable and cash are less than 50% of total assets; and

- Total interest and non-compliant activities income are less than 5% of total revenue.

3. Dividend Purification

Sub-adviser will publish per share amount of dividends that requires purification. Investors may purify that portion by absolving an equivalent amount to charitable purposes.

INDEX PAGE

Not available. Here is the page for a non-capped Global REIT index. Name doesn't match the one in the prospectus, so it may still be under development and not actively calculated and published yet. There's a mismatch in the name of the index in the prospectus as well, as it's missing an "h" at the end of "Sharia", which is how S&P names it's Shariah indices.

Wednesday, October 14, 2020

Two Actively -Managed ETFs to launch this week on NYSE Arca!

Leatherback Long/Short Absolute Return ETF

Leatherback Long/Short Alternative Yield ETF

Two actively-managed ETFs to launch this week on NYSE Arca: Launching under the Tidal ETF white-label structure. Leatherback, the sub-adviser, is probably eager to launch an ETF so using Tidal ETF's services to do so. I am guessing the name of the sub-adviser is a poetic (?) reference to the testudine's ability to grow slowly even in the harshest of environments.

Leatherback Asset Management ETFs

Summary (see prospectus for full info):

Leatherback Long/Short Absolute Return ETF

Ticker: LBAR

Expense ratio: 1.13%

Investment universe: U.S. stocks

Investment Strategy:

The fund will go long from 0 to 80%. Fund will invest mainly in stocks, but also invest in bonds, sometimes.

Sub-adviser will decide on long positions based on:

- quantitative and fundamental analysis

- focus on companies with high margins and high return on invested capital

- in industries that Eli expects to outperform over a several year period

- will consider securities with dividends with growth, or no dividends at all

- companies with unique opportunities (spin-offs, emerging from bankruptcy, etc)

Leatherback will decide on short positions by:

- looking for financial/accounting anomalies in companies' financial statements

- identifying short term fads leading to overvalued securities (reminds me of tamagotchi)

- looking for companies with poor governance records (what's the definition of poor governance, what's the threshold?)

- buying put options on equity securities or ETFs (sloppy throw-away line: like, in general?? What is the method to decide which ones to buy puts on??)

Leatherback Long/Short Alternative Yield ETF

Ticker: LBAY

Expense ratio:1.09% (little less juicy than the other one, which makes sense as the focus is on yield and expenses cut into that)

Investment universe: U.S. stocks

Investment Strategy:

The fund will go long from net 75%-110%. Fund will invest in securities believed to provide sustainable shareholder yield (defined as dividends plus buybacks plus debt paydowns) and taking short positions in securities expected to decline in price.

LBAY may write (sell) covered calls up to 100% of the value of the Fund’s individual equity security or an index when Leatherback believes call premiums are attractive relative to the price of the underlying security or index.

Sub-adviser will decide on long positions based on:

- whether security is expected to pay a dividend and ability to grow that dividend

- quantitative and fundamental analysis

- focus on companies with high margins and high return on invested capital

- in industries that Eli expects to outperform over a several year period

- will consider securities with dividends with growth, or no dividends at all

- companies with unique opportunities (spin-offs, emerging from bankruptcy, etc)

Leatherback will decide on short positions by:

- identifying idiosyncratic ideas that suggest a security's price will decline (actual words written in the prospectus!)

- looking for financial/accounting anomalies in companies' financial statements

- identifying short term fads leading to overvalued securities

- looking for companies with poor governance records

- buying put options on equity securities or ETFs

ARK files for new ETF tracking Transparency Index

Name : ARK Transparency ETF Ticker : TBD Exchange : TBD Expense ratio : 0.00% Original filing date : August 31, 2021 Effective date : N...

-

PSYK ETF Ticker : PSYK Exchange : NYSE Arca Expense ratio : TBD Summary Tracks an index of 25 companies listed in the USA or Canada involve...

-

Name : ARK Transparency ETF Ticker : TBD Exchange : TBD Expense ratio : 0.00% Original filing date : August 31, 2021 Effective date : N...

-

10 ETFs listed in the U.S. this week On the one hand we are seeing a maturing of the ETF market with this broad range of ETF launches, but i...